We have all heard of Inflation, on the news, in the headlines, on Twitter Instagram, from your parents, and pretty much everywhere people are talking about the economy in any context. But, what is inflation, what does this elusive and scary word actually mean? Should we be afraid of what is happening, are prices skyrocketing, and will we be able to afford bread in the future, much less homes? Well if these are the questions on your mind, do not worry because much of what you may have heard is, well - Bullshit.

As I do not assume any level of previous understanding from you, dear reader, I will endeavor to create as clear and as simple a picture of this concept as possible. I will also attempt to do so in a way that shows you exactly how you may expect inflation to play a role in your life.

What is it??

While there is not too much debate over what inflation is and what the term means, it is nonetheless important to set it down before we continue to discuss it. Inflation is defined as the gradual increase in the price of goods or services over time such that there is a decline in the purchasing power of money. So, essentially, it is a process through which the money in your pocket is worth less and less.

Now many people have put their own spin on what this means or how it works. My father has always called inflation a tax on savings, in that as prices rise and the purchasing power of the dollar diminishes, the money you have sitting, stored away is effectively worth less and less as though some invisible force is taxing it right from you.

Inflation takes many forms as it is such a broad definition, the price of which good or service and the magnitude of the increase, all contribute to layers of complexity that affect the number on the tag you see at the grocery store. However, there are two primary ways we differentiate inflation and by extension track it, those being the Consumer Price Index and the Producer Price Index.

The Consumer Price Index is what we call a “basket of goods” measurement, in that we essentially (not literally) go to the store, by a selection of items, and note the price, returning at a later date to note the change.

The Producer Price Index measures the selling prices of output for producers. These outputs represent the first link a chain that ends with a final product going to the consumer.

Between these two indexes and their respective methodologies, we have a solid foundation for what inflation is. Please note also that those of you who are curious may navigate to the Bureau of Labor Statistics which tracks these indexes through the links embedded above.

Where does it come from??

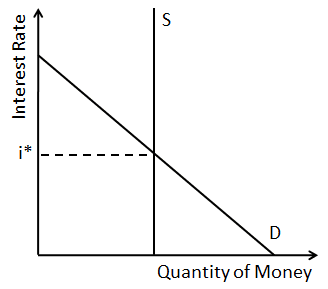

Before I can explain how inflation occurs I need to introduce you to this graph. Most of you have probably seen it at least once in your life, but if you don’t remember, allow me to explain. This graph depicts price as a function of quantity across the supply and demand curves. Price is the y axis and quantity is the x axis with supply representing the blue upward-sloping graph and demand representing the red downward-sloping graph.

In its base state, supply and demand intersect and the price and quantity at that point hold what are called equilibrium values. When one, the other, or both of these curves shift, it causes the price and quantity to deviate from the equilibrium value, and in the case of inflation, prices rise. So what causes a price to rise? Well, the demand curve will either shift out or the supply curve will shift in. This represents at a very basic level, either more people buying/demanding a good or service, or a good or service becoming more difficult/expensive to produce.

There are a myriad of determinants that cause these shifts in the supply and demand curves which contribute to the complexity of the issue and the subsequent difficulty of its solution. However, some of the primary determinants are as follows:

Demand:

Increase in Consumer Income

Change in Consumer Preferences

Increase in Population

Expectations of Future Price Increases

Supply:

Increase in Production Costs

Government Regulations or Taxes

Natural Disasters or Supply Chain Disruptions

Decrease in the Number of Supplies

It is important to note that fundamentally, many of these determinants are the result of a booming economy, which is why I like to call inflation the heat that comes off an economy. As such, inflation is a natural byproduct of growth and expansion. It is when the pace of inflation becomes too rampant, and when inflation begins to outpace the growth of wages, leading to crises of purchasing power that we run into trouble.

How do we stop it??

Now that I have explained the concepts of supply and demand, we can transfer this knowledge to monetary and fiscal policy. You have probably heard these terms used on news shows or in political opinion articles. Both of these are tools used by the government to affect the state of money supply and money demand. As explained above, supply and demand represent opposing relationships that form the basis of prices and quantity, but in the context of monetary and fiscal policy, these supplies are the supply and demand of money itself.

Monetary policy is a function of the Federal Reserve which manipulates the money supply in two ways. First The Fed sets what is called the “Federal Funds Rate” which is the overnight rate at which banks borrow and lend from each other and from the Fed itself. When the Fed increases or decreases this rate it essentially becomes more or less expensive to borrow money, and thus speeds or slows the creation of loans. More loans mean more money circulating the economy and thus more spending leading to higher inflation from an increase in demand. Fewer loans have the opposite effect.

Fiscal policy is another function of the government which involves spending and taxes. When the government spend money, particularly large amounts of money, it increases the money supply and subsequent spending which drives inflation. Taxes on the other hand reduce the disposable income of people and businesses resulting in decreased inflation.

Do we need to fear??

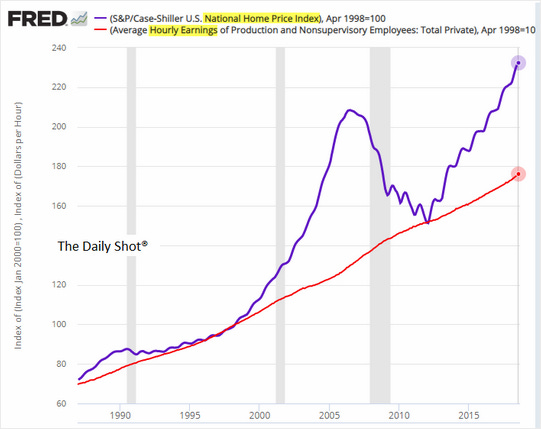

While we have all heard the doom and gloom about inflation recently, and it is certainly not fun to see these rising prices, there are a few grounding facts to be aware of. Firstly, overall inflation has remained around 3.5% over the last 30 years with breaif periods of hikes, the most recent of which occurred during the pandemic, but ultimitately they always fall to the average over time. Secondly, a key issue of inflation that is used to stir fear is often the prices of specific goods and services. Ultimately, while overall inflation may remain at a constant level, it is certainly true that inflation in certain industries and sectors is the cause of the majority of strife.

One of the notable exceptions to the more moderate trend of 3.5% inflation, is home prices which have increased at a rate notably higher than wages. While the growth in these prices is indeed cause for concern, evidence suggests that the climb in housing prices is running out of steam and is likely to level off in the next 10-15 years.

What we should remember here are three things:

Inflation is a natural byproduct of supply and demand trends as well as economic growth.

Overall inflation has remained at a relative average for the last 50 years with notable exceptions (housing) that should be the focus of legislative action, rather than the vague term “inflation” itself.

These trends are fairly cyclical in that wages and inflation play a tug of war of sorts such that one grows and the other follows.

So what do you do with this information? Well my recommendation is do not panic, but rather be mindful of the reality of inflation make safe investments with your savings to avoid their erosion over time, and be cognizant of your real wage growth

But that is just what I think, if you disagree, agree, have questions or just want to call me stupid I emplore you to please answer, subscribe and comment below!

Selected Sources

https://news.harvard.edu/gazette/story/2023/11/why-americans-feel-inflation-economy-are-much-worse-than-they-are/

https://time.com/archive/6870757/inflation-fears-state-of-mind-v-state-of-facts/

https://news.stanford.edu/stories/2024/08/grumpy-economist-weighs-inflations-causes-its-cures

how much of an impact does psychology and societal standards have on some aspects of inflation? - ryan kim